One of the seminal moments in American independence is the Boston Tea Party, which accurately sums up the American attitude towards taxes. I’ve lived in a few countries so have seen both ends of the spectrum – too little (or rather lax enforcement) and too high taxes. Both extremes are not ideal.

Personally, I have come to accept that taxes are inevitable, and may be the price we pay to live in civilization. Nonetheless, I don’t like paying taxes and don’t know of one person who likes paying them either.

This article is dedicated to showing you how passively investing in multifamily deals is possibly the best way to (legally) reduce your taxes to an almost ridiculous level.

Proto real estate investors showing King George how they cost segregate, Boston style

On a personal note, apart from my family’s background in commercial real estate investing, taxes — or rather managing our tax position — was a big reason for becoming a CRE sponsor. A few years ago when I moved to the US, I realized that we were comfortably paying in the six-figures in taxes. Nice problem to have which, hopefully, was going to only get worse if we didn’t take some corrective measures.

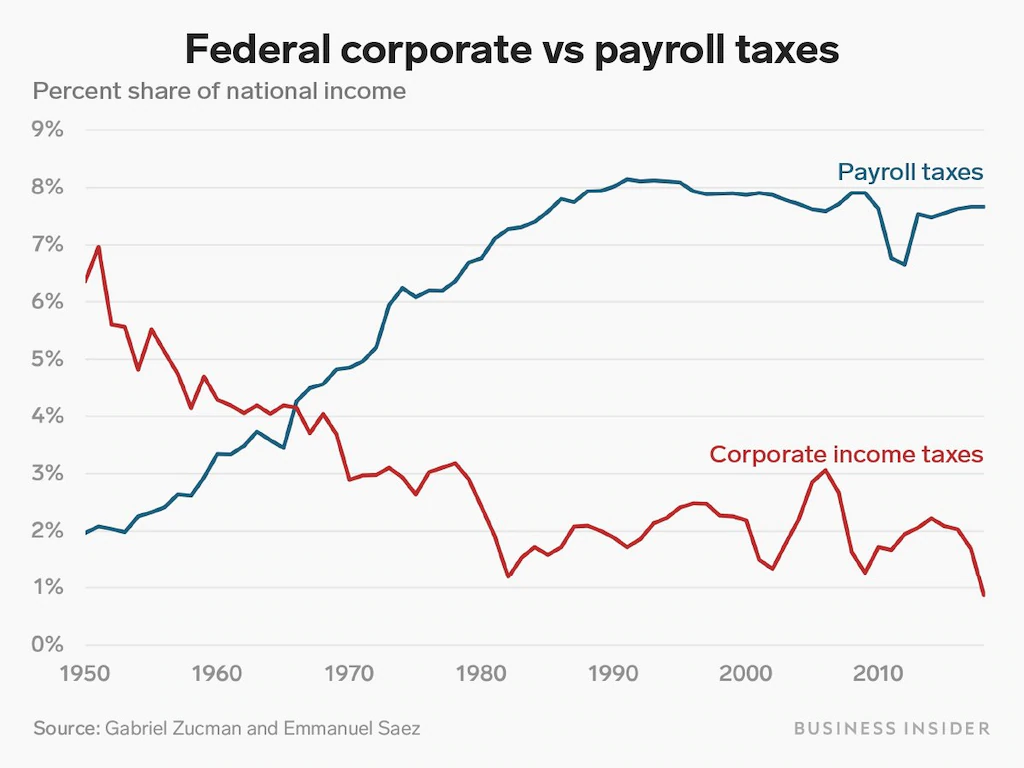

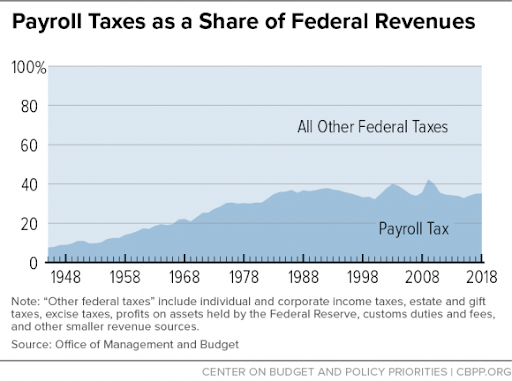

Warren Buffet has famously said that he pays lower taxes than his secretary. The tax code in most countries heavily penalizes the returns generated by labor over capital. This is why we see a multitude of high-income earners — doctors, lawyers, accountants — who make more money than before but have the fear of financial insecurity looming over their shoulders.

The heavily advertised tax cuts disproportionately flow to the top 0.01% (or individuals who generate the bulk of their income through capital gains).

One can choose to be angry at the rich supposedly getting away with paying less taxes… or join the club. Life is so much better on the other side of the tracks!

Tax On Labor VS Tax On Capital

Image Source: Business Insider

Image Source: CBPP

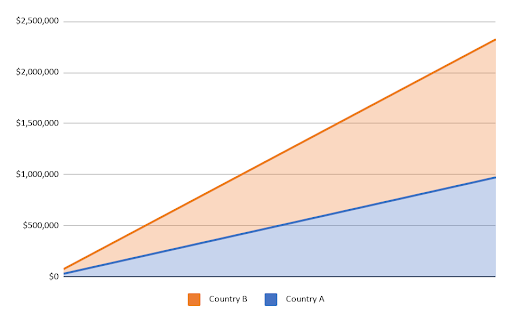

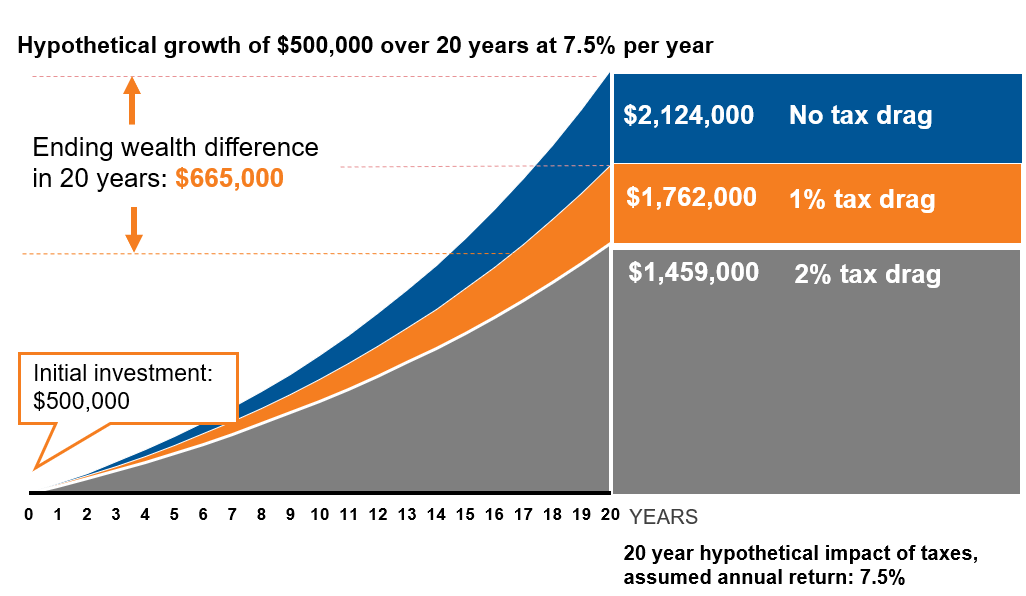

Taxes are a major drag on returns. Tax drag is the reduction in potential income due to taxes. The concept describes the loss in returns, usually on an investment, as a result of taxation. Tax drag is commonly used when describing the difference between an investment vehicle that is tax-sheltered and one that is not.

An example will illustrate this point nicely. Suppose an individual can invest $1 million in two securities: one in Country A (35% withholding tax) and one in Country B (10% withholding tax). Both securities pay a 5% dividend. The chart below illustrates how much of a difference taxes play in overall returns:

You can click on the image above to refer to the source file.

Download it and enter your own numbers to map out various scenarios.

Only a slight difference in tax policy makes the difference between having a multi-million dollar investment or not!

Tax implications are important to consider. Promoters love to tout their returns but rarely include the tax consequences. These are often dismissed under the guise of “each investor has his own unique tax considerations.” This is a polite way of only showing you the good without any of the bad.

Astute investors like to reinvest their returns. Taxes eat into those reinvested profits leaving less to reinvest and less to grow on a compounded basis. This has massive repercussions for an investor’s portfolio over the long run as small differences result in wildly divergent results.

Image Source: Seeking Alpha

Individuals can take advantage of tax-sheltered and tax-advantaged vehicles. For most households this means a company retirement plan (401k) or IRAs. Families with kids often throw in the college education plan (e.g. 529 savings plan) but that’s it.

Sophisticated investors will have an allocation to alternative investment types (like commercial real estate).

So now let’s dig into some of the biggest tax breaks available to US multifamily investors.

Accelerated Depreciation AKA Cost Segregation

Most countries allow some form of real estate depreciation. The US takes the cake by putting normal real estate depreciation on steroids via the cost segregation. Accounting nerds understand this as being simply accelerated depreciation.

This truly is one of those items that is too good to be true and only available in the US. So how does it work?

Depreciation works on the principle that properties, like other assets, depreciate over time. This is the accounting allocation for the “wear and tear” on properties over the years. However unlike most assets, in reality real estate values can progressively increase with proper maintenance for the asset located in the right area.

Regardless of the profitability of the property, investors can deduct a depreciation expense from their real estate income to reduce, mostly or completely, their real estate based income tax.

So how do you do this magic trick?

The IRS considers the useful life of a residential property to be 27.5 years (39 years for commercial properties). Therefore, residential property owners can deduce a depreciation expense for that amount using the straight-line method.

e.g. Let’s assume that a property is valued at $5.5M. Therefore the annual depreciation expense would be $200K (or $5.5M / 27.5 years). This means that you can deduct up to a maximum of $200K against taxable real estate income (unless you are a real estate professional, in which case you can deduct the whole amount, but that is a topic for another time).

Hence if the property generates $300K income (and assuming the investor is not a real estate professional) and the tax rate being 30%, the taxes owed would be:

- Without depreciation: $300K * 30% = $90K

- With depreciation: ($300K – $200K (depreciation write-off)) * 30% = $30K

This translates into a savings of $60K annually or 20% increase in income (vs. $300K total income generated). Not a bad ROI!

The recent “Tax Cuts and Jobs Act” (TCJA) temporarily increased the allowance for what is called bonus depreciation. Without boring the reader to death on arcane tax matters, this increase in bonus depreciation has doubled (to 100%) which allows an investor to immediately expense personal property and improvement in the year of purchase or when the work was performed. And if that expense produces a loss, it can be carried forward into future years.

1031 Exchange

As far as I know, no other country offers this benefit to real estate investors.

Basically, in a 1031 Exchange, capital gains taxes on real estate can be deferred forever and the assets pass on to beneficiaries upon the death of the investor at a stepped-up basis. In other words, the taxes are wiped away as investors trade into larger and larger real estate assets.

Qualifying for the 1031 requires meeting a few conditions:

- New property must be equal or greater in value than the existing property

- Swapped property must be used for productive business purposes

- Both properties have to be “like kind”

The step-up is where the 1031 Exchange goes into funny-money territory. This is where non-US residents become extremely jealous of American investors seeking to create a legacy.

Upon death, beneficiaries receive a “step-up” in basis. That means the (significantly appreciated in value) real estate that gets passed on to your heirs is treated as current fair market value at the time of inheritance. If they sell for that current market value they wouldn’t incur a capital gains tax because that is the value at which they received the asset (rather than the taxman looking at the property’s value at the time you acquired it).

So those “lucky” enough to have died while always exchanging (or never selling) find another loophole to avoid paying taxes on their assets… and their heirs are the happier for it.

If even a portion of the reason you are saving, investing, and building wealth is for the future security of your family, then it cannot be overstated what an advantage a 1031 Exchange will be.

This is the part where you light a sparkler, salute the American flag, and start chanting “U-S-A! U-S-A! U-S-A!”.