Accredited investors can build a legacy of financial freedom for their family, if they choose the correct asset.

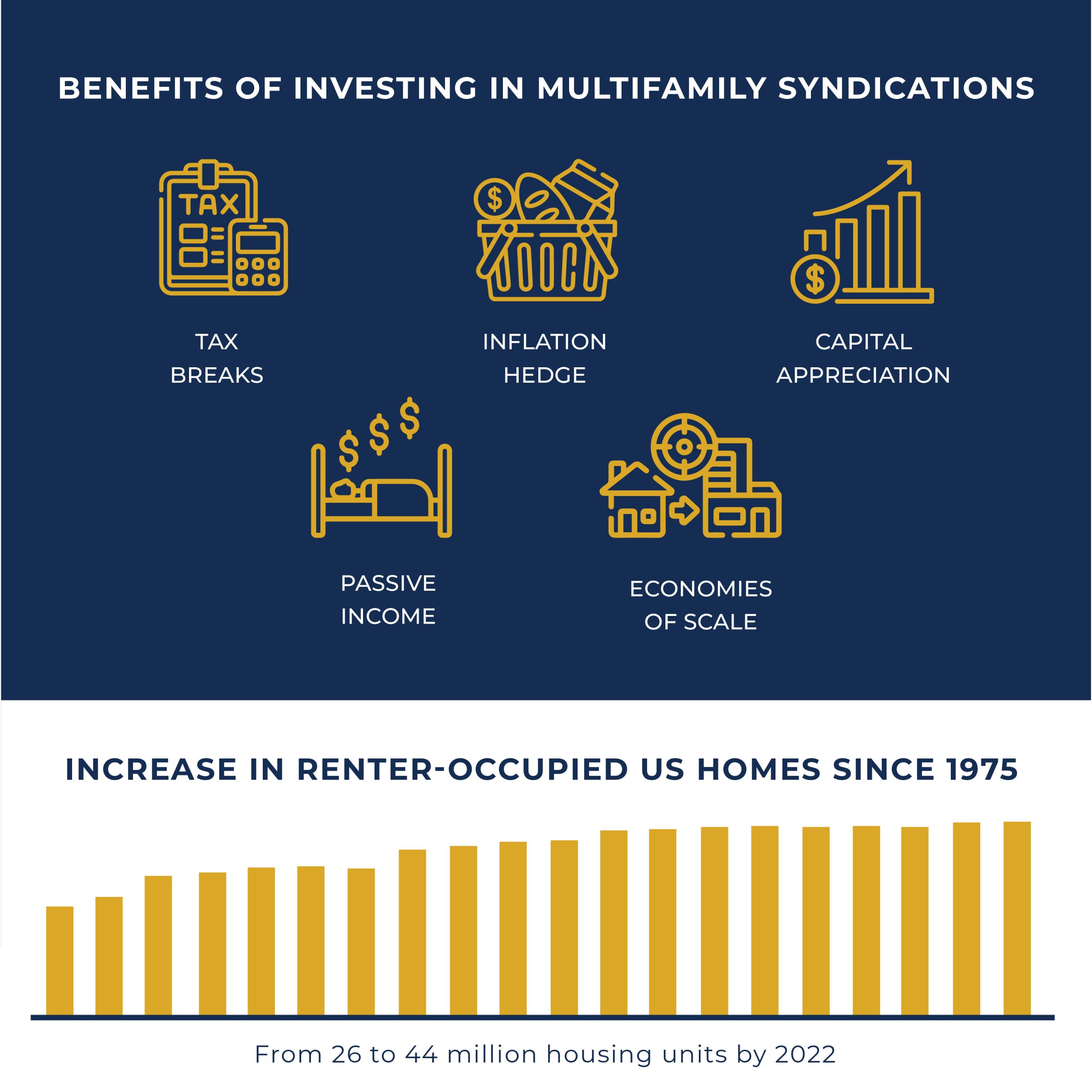

Here are the top 5 ways that multifamily syndications are superior to stocks, bonds, collectibles, and even residential real estate, in terms of creating a high net worth lifestyle.

1. Tax Breaks & Tax Deferrals

High income earners have a hidden expense called taxes. It’s never about how much you make; it’s about how much you keep.

The partners in a multifamily syndication receive accelerated depreciation benefits that they can use to offset their profits (in many cases the deductions go up to 40%-60% of the invested capital).

Plus, at the sale of a multifamily property, investors can use a 1031 Exchange to defer capital gains taxes and reinvest 100% of their profits (rather than immediately losing ~20% to taxes) in a new deal. That means your maximum capital stays at work for you.

Real estate produces some of the best tax-friendly profits available.

2. Truly Passive

The last thing any successful individual needs is to work even more. Instead, you need your money working for you.

So instead of being a landlord, partners in a multifamily syndication get all the benefits of real estate ownership but with a full-time team of experts managing the finances and operations for them.

3. Access Economies of Scale

Scale is another way that multifamily investors are rewarded over residential real estate.

Repair and maintenance charges are much lower for “wholesale” operations, and more reliable in terms of scheduling.

Scale also de-risks downside events like vacancies. If you own a rental home or suite and your tenant leaves, your entire cash flow comes to a halt. On the other hand, an apartment complex allows owners to manage vacancies and stay profitable.

For the same (or even less) capital, a partner in a multifamily syndication can leverage this safety of scale by participating in a much larger and higher value asset.

4. Exponential Power of Forced Appreciation

“Buy low, sell high” sounds good — but how can you take steps to almost guarantee this will happen?

The key lies in value creation.

A wise real estate syndicator will either acquire an existing property armed with a clear and proven business plan to “value-add”, or will develop an entirely new property where the project’s location and economics can create massive value.

Forced appreciation is primarily driven by:

- buying / building discipline

- experienced, hands-on asset management

- thoughtful & timely maintenance (at the efficient rates of a large-scale operation)

- lender relationships in order to finance or refinance at favorable rates

A multifamily investment does not just get purchased and then “hope the market goes up”. The entire syndication structure is devoted to constantly looking for ways to increase value or reduce expenses.

5. Unfair Cultural & Economic Advantages

The US government, it’s tax code, and the economy are geared towards rewarding property owners. Rising real estate values are a major marker as well as an inflation hedge, and (most of the time) interest rates related to real estate are comparably quite low.

Housing is also a basic need, with (again, comparably) steady demand.

Along with the previously mentioned extra tax breaks, all these factors result in the multifamily real estate investor receiving — frankly — unfair advantages over every other type of investor.

It’s not hard to see that multifamily real estate, owned via a syndication, is a superior vehicle for wealth protection and wealth building.

That said, the vehicle still needs a capable driver…

Want An Expert Team With A Proven Track Record To Source, Select, And Shepherd Your Multifamily Investments?

Join our email list now to learn how we have helped our investors.