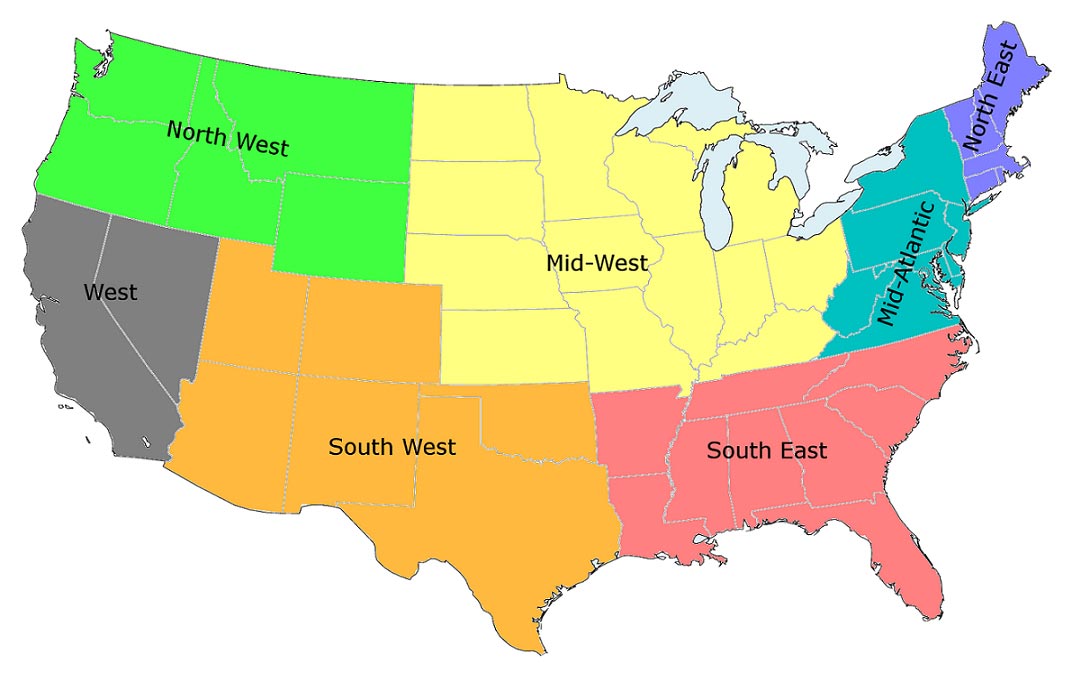

The US is divided into 7 major regions with 400 metropolitan areas (MSAs). Using a blanket term like “US housing market” just does not work. The beauty of investing in the US is that there is so much to choose from at each price point.

Each MSA has a sub-market that is divided into suburbs, which are divided into streets. The location relative to the street dictates the trends, rents, employment opportunities, school districts (referred to as: independent school districts of ISDs), capitalization rates… the list is endless!

The first question all investors ask is “How do I choose the right market?”

I’ve developed a quick 4-step framework to choosing a right market:

- Understand Market Types

- Identify the Right Markets

- Choose the Right Markets: How to Become a Pro!

- Visit the Market

Understand Market Types

There are 3 types of markets:

Linear: Generally, these markets appreciate at the rate of inflation. They exhibit a “flat” growth curve with no major spikes or declines. Boom and busts rarely occur as these markets keep chugging along.

Some people consider them “boring” because of their “lower” appreciation. But these markets provide some of the best capitalization rates and cash-on-cash returns.

Major linear markets are found in the Midwest, Southern Texas, South-Eastern Georgia.

Cyclical: In these markets, property values move up and down like a rollercoaster with peaks and troughs. The real estate cycle length varies between 7 to 10 years.

When conditions are ripe, annual housing price gains can exceed 20-30%. However, these markets face similar downward price volatility as well.

Major linear markets are coastal regions, with San Francisco, Seattle, New York, New Jersey and Florida being the major ones.

Hybrid: As the name implies, these markets exhibit a combination of linear and cyclical characteristics. They can have linear, slow-growth for a period of time followed by period of moderate cyclical-style appreciation. They never boom and bust like Florida or California, but they also never correct like more volatile markets either.

Good examples include Austin (Texas), Boulder (Colorado), Charlotte (North Carolina) to name a few.

Identify the Right Markets

When researching a market, there are several facets to consider. These include (but are not limited to):

Population: I prefer to invest in MSAs with a population of 750,000 or more. More often than not, the higher the population the better the chances of success.

Jobs: I prefer to invest in markets with, at least, 3 different industries. Some industries I like include manufacturing, health-care and technology. Ideally, I prefer to have no one employer/industry employ more than 15-18% of the population. My best advice is to not invest in cities that rely on one industry.

Jobs Growth and Migration: Investors should look at steadily growing populations with positive migration trends. People constantly moving for employment opportunities signifies a healthy, vibrant economy.

Affordable Housing Market: As a rule of thumb, I run a rent-to-value (RV) ratio on potential investments. The RV ratio is simply the monthly rent divided by acquisition price, expressed as a percentage. My target RV ratio is between 1.2-1.4%; anything less is too expensive (will not cash flow), anything above is, probably, a depressed market or a bad neighborhood.

Vacancy Rates and Time on Market: A property purchase at a bargain rate is no good if you cannot find a renter. Therefore, I pay close attention to evaluating trends in the number of vacant properties and average time to fill a vacant rental.

Ratio of Owner-Occupied to Rental Properties: Markets with higher percentage of renters creates a deeper pool and demand for quality rental units.

Housing Sale Statistics: Even for long-term, buy and hold investors, the ability to sell a property and receive a reasonable price is critical to the underlying exit strategy (remember: always have more than one exit strategy). This factor is a solid macro indicator of the overall health of the real estate market. Some points to consider: trends in inventory supply, time on market and asking vs. sales price.

Moderate CAP rates: To achieve strong annual returns, the economy of the market must be very strong but exhibit CAP rates greater than 5-6%.

Thriving or Emerging Downtown: Since the Great Recession, many 2nd tier cities across the US have seen resurgence in their downtown areas. This is due to changing habits, as renters are demanding more amenities in their local communities.

Regulatory Factors: Some markets are friendlier than others. Two individual properties with similar dynamics – cost, condition, rental potential – can exhibit very different results based on regulatory factors like tax policy and landlord friendly laws (discussed below).

Landlord Friendly Laws: Having lived in the northeast (US and Canada), I have experienced unfriendly landlord laws. By investing in states with landlord friendly laws you reduce long-term stress and hassle. A property manager’s job is made easier as they can evict problem tenants easily.

Choosing the Right Markets – How to Become a Pro!

In my experience, investors need to analyze at least 25 deals in a selected market before they become a pro.

Simply put, go online – LoopNet, Showcase, Craigslist – and start crunching numbers in a spreadsheet. This is unsexy work, but analyzing 25 deals will give an investor a feel for costs – avg. $/door, expense ratios, average rent/sub-market, demographic trends. This step is extremely valuable to anyone looking to vet a potential market and must not be skipped!

Visit The Market

Visiting the market will help an investor understand the lay-of-the-land and establish their bearings. It also provides a better understanding of the types and condition of the target and comparable properties.

I hope my framework is helpful in helping you choose the right market and attain financial freedom. If you have any questions, I would love to hear from you. Happy Investing!

References: